Canada’s largest city often reflects many of the same housing and economic issues experienced nationwide. However, Toronto also possesses its own sets of unique draws and pain points within its market. The city’s financial opportunities and multicultural flavor make it a draw for Canadians and immigrants.

However, inflation, combined with a lack of affordable housing, has made Toronto one of the most expensive cities in Canada. Unpacking the pros and cons requires a deeper dive into Toronto’s market.

Toronto is a financial powerhouse

Toronto, Canada’s financial hub, is the second-largest economic center in North America, trailing only behind New York. Globally, it ranks seventh in terms of employment within the financial sector.

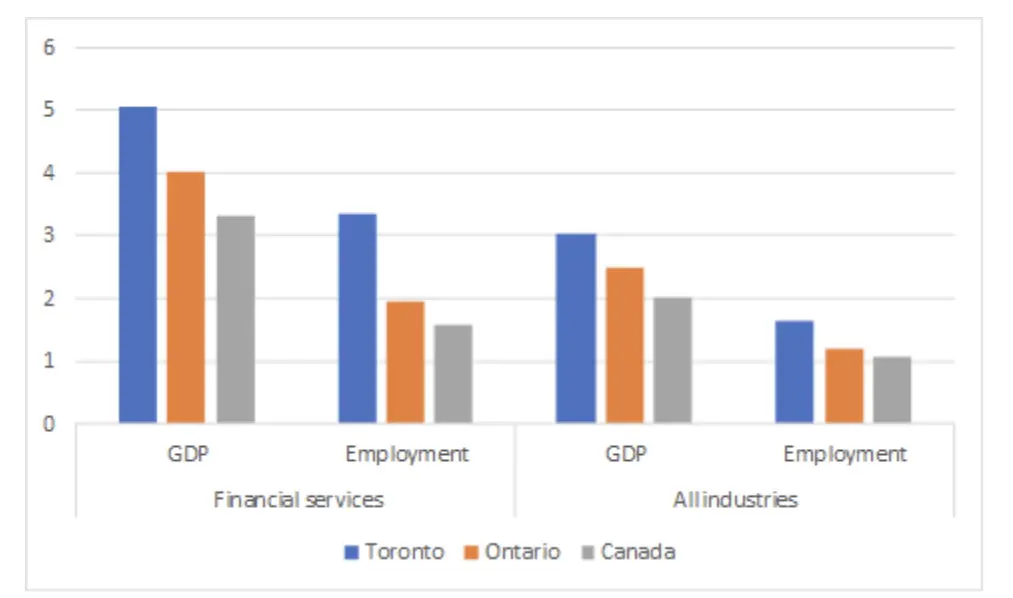

According to a report by the Conference Board of Canada before the pandemic, the period between 2014 and 2018 saw remarkable growth in employment and GDP within the financial services industry. This growth surpassed the averages observed across all sectors in Canada, and underscores Toronto’s significance as a financial powerhouse, contributing substantially to the economic landscape locally and on a national and international scale.

In 2023, Toronto gained 107,100 new jobs. Several industries contributed to this growth, with transportation, healthcare, and education among the frontrunners. Specifically, transportation added 40,900 jobs, while the healthcare and education sectors experienced increases of 35,500 and 14,500 jobs, respectively, compared to the previous year.

Growth in employment across various sectors reflects Toronto’s dynamic economy and ability to attract businesses and skilled workers.

A significant rise in population and employment growth

Between 2016 and 2021, three cities in Canada attracted the largest shares of new immigrants: Toronto, accounting for 29.5 percent of the total; Montreal, with 12.2 percent; and Vancouver, with 11.7 percent.

Statistics Canada projections indicate that by 2041, most of the immigrant population will continue to reside in a Census Metropolitan Area (CMA), with Toronto, Montreal, and Vancouver remaining the primary areas of residence.

Regarding population growth, Toronto emerged as the fastest-growing metropolitan area in Canada and the U.S. in 2019, surpassing Dallas–Fort Worth–Arlington for the top spot. Moreover, Toronto was the fastest-growing central city in both countries during the same year, as the Centre for Urban Research and Land Development at Toronto Metropolitan University reported.

In 2022, Toronto retained its prominence as the second fastest-growing metropolitan area in Canada and the U.S., flipping positions with Dallas compared to 2019, according to data from Toronto Metropolitan University.

A 2018 study conducted by Hemson Consulting and SvN Architect and Planners highlighted a promising outlook for employment growth in Downtown Toronto. According to their findings, the anticipated job additions in the downtown area from 2016 to 2041 range from 193,000 to 316,000, reflecting a robust potential for expansion. The mid-range scenario, which foresees the addition of approximately 254,000 new jobs, suggests a substantial uptick in employment opportunities.

Toronto’s world-class universities draw students from around the globe

Downtown Toronto boasts a wealth of renowned educational institutions, including the University of Toronto, which has consistently earned high rankings in prestigious lists such as the QS World University Rankings 2024 (21st globally) and the US News & World Report 2022-2023 (18th globally).

Additionally, other prominent universities, such as York University and Toronto Metropolitan University (formerly known as Ryerson University), contribute significantly to the region’s academic prestige and potential for talent development.

On track: Toronto’s Home Price Index, expanding public transit, and safety

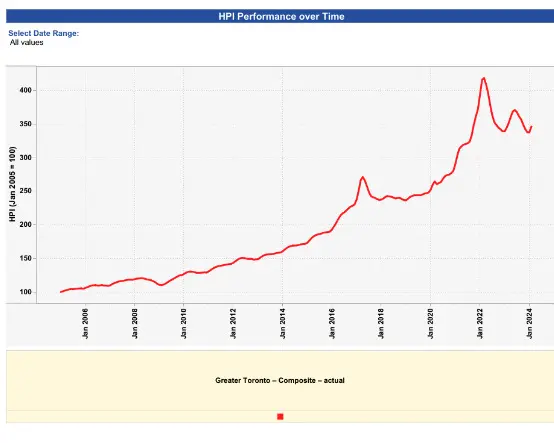

The Canadian Real Estate Association’s (CREA) MLS Home Price Index is widely regarded as one of the most comprehensive sources for tracking changes in home prices over time. Toronto’s Composite HPI, which covers all residential property types, has been steadily climbing for the past two decades, with the most significant growth occurring between January 2016 and present day.

Given the size of the city, public infrastructure is critical to assisting the transportation of Torontonians from Point A to Point B. Several major transit infrastructure projects are underway, including projects such as the Eglinton Crosstown and Eglinton East Light Rail Transit, Finch West Light Rail Transit, the Go Expansion Program, as well as several others throughout the GTA.

The Ontario Line subway, currently in progress, is a 15.6-kilometre subway route designed to enhance travel efficiency within Toronto and its surrounding areas. Upon its opening in 2031, it’s projected that as many as 388,000 individuals will utilize the Ontario Line daily.

Toronto is ranked as the safest place to live in Canada by Money.ca, based on 2021 data from the Canadian Crime Index. Additionally, Toronto is recognized as the second safest city in the world according to the Economist Intelligence Unit’s biennial 2021 Safe Cities Index, which assesses digital, health, infrastructure, personal, and environmental security factors.

Despite its many draws, Toronto faces difficulties due to lingering inflation woes, high interest rates, rising unemployment, and a significant lack of affordable housing.

Canada’s labour market encountered headwinds in 2023

Canada’s labour market found itself treading carefully in 2023, dealing with the pressure of high interest rates. Employment growth slowed, causing the national unemployment rate to increase 0.8 percentage points between April and November.

“The first half of the year was like a sprinter in full stride, with Canada adding an impressive average of 48,000 jobs monthly,” said Jasmine Cracknell-Young, vice president, advisory for Zonda Urban. “Yet, as the year progressed, the pace slowed considerably. By the second half, the monthly average dropped to a mere 23,000 positions, starkly contrasting the robust start.”

Canada added 41,000 jobs in February 2024. However, this impressive number was dimmed by a sobering reality: employment gains continued to lag behind the surge of population growth. The employment rate experienced its fifth consecutive decline in February. Such prolonged contraction hasn’t been witnessed since the fallout of the Great Recession in 2009.

Canada’s unemployment rate edged up to 5.8 percent in February. Fueled by the mismatch between job creation and population expansion, this uptick paints a portrait of the country’s economic challenges.

“Taking a closer look at Toronto, the narrative is a little less positive,” said Cracknell-Young. “In 2023, sectors such as finance, insurance, real estate, rental, and leasing collectively shed 41,600 positions. The city’s seasonally adjusted unemployment rate rose to 7.4 per cent in February, above the national average.”

Toronto’s workforce now finds itself in a precarious position. The city gained 232,800 working-age individuals in 2023, against the 107,100 jobs it added. As population growth outpaces job creation, securing employment in the city has become difficult for many Torontonians.

Unraveling Canada’s immigration conundrum: Balancing growth with affordability

Within Canadian policy, immigration is a thread woven into the fabric of economic growth and cultural diversity. Since 2015, the Trudeau government has orchestrated many immigration initiatives to bolster economic expansion and mitigate labour shortages. However, this progress has frustrated many Canadians, mainly regarding housing affordability.

According to a recent poll conducted by Ekos Research, support for immigration has plummeted to a three-decade low. Unaffordable housing is cited as the primary grievance, and in response to these mounting concerns, the federal government has taken decisive action, signaling a shift in immigration policy.

In a bold maneuver aimed at tempering the influx of international students, the government announced plans to cap the issuance of undergraduate study permits. Set to take effect in 2024 and 2025, this reduction represents a significant departure from previous trends, with a projected 35 percent decrease in permits granted compared to 2023. The allocation of permits will be divided among provinces and territories based on population, fostering a more equitable distribution of educational opportunities across the nation.

Meanwhile, Toronto has embarked on its journey toward housing reform. With the approval of the City Council, a new 10 percent tax on the purchase of Toronto homes by non-Canadian entities is slated to come into effect in 2025. Mirroring a provincial policy introduced in 2017, this tax seeks to mitigate the influence of foreign buyers on the city’s real estate market, augmenting existing measures to safeguard affordability.

However, the anticipated revenue influx from the new tax will be tempered by the federal government’s decision to extend a ban on most foreign home purchases until at least 2027. While this measure aims to preserve domestic ownership, it also underscores the balance between economic imperatives and housing affordability.

Exemptions within housing policy show nuance within the broader narrative. Non-Canadians seeking to invest in vacant land or residential development will find refuge from taxation, while international students and skilled workers are afforded pathways to homeownership under certain conditions.

Against the backdrop of growing condominium ownership by investors and escalating rental inflation, the federal government has set its sights on recalibrating immigration targets. Capping admissions of new residents at 485,000 in 2024 and scaling to 500,000 in subsequent years, Canada still seeks the fine line between growth and affordability.

Housing affordability crisis deepens in Greater Toronto Area as incomes lag behind soaring prices

In demonstrating the widening gap between housing costs and incomes, data from the Greater Toronto Area (GTA) paints a grim picture for prospective homebuyers and renters. Over the past 13 years, housing prices have surged to unprecedented levels, outpacing the growth of household incomes by a significant margin.

According to recent statistics, the average home price in the GTA has skyrocketed to $1,134,781, nearly doubling its value 13 years ago. This escalation in housing costs has far outstripped the pace of income growth, rendering homeownership an increasingly distant dream for many residents.

For renters, the situation is equally dire. A retrospective analysis reveals a steady upward trajectory in rental prices over the past three decades, exacerbating the challenges individuals and families face when seeking affordable housing options.

In 2000, renters paid an average of $913, adjusted for inflation, which would amount to $1,514 in today’s currency. Similarly, in 2010, the average rent stood at $1,048, equivalent to $1,425 in today’s terms. By 2022, renters were shelling out an average of $1,665, which rose to $1,732 in 2023, marking a staggering 35% increase since 1990.

However, amidst this relentless surge in housing costs, the growth in median incomes has stagnated, failing to keep pace with the runaway inflation in real estate prices. When adjusted for inflation, median incomes for individuals aged 25 to 54 have remained virtually stagnant over the past three decades, according to data extrapolated from the 2021 census.

In 1990, the median income for individuals in this age bracket stood at $54,310 when adjusted to reflect 2023 inflation rates. More than 30 years later, this figure barely budged, inching marginally to $54,643 by 2023. This stagnation in income growth, juxtaposed against the massive rise in housing prices, underscores the deepening crisis of affordability plaguing the GTA housing market.

The implications of this widening disparity are profound, posing significant challenges for aspiring homeowners and renters alike. As housing costs spiral beyond the reach of median incomes, the dream of secure and affordable housing remains an elusive reality for many residents in the GTA. With no respite in sight, policymakers and stakeholders must address this burgeoning crisis and devise strategies to restore housing affordability for all community segments.

Housing starts dip nationally in 2023, but rise in Greater Toronto Area amidst market shifts

Recent data on housing starts in Canada reveals a nuanced picture of the real estate landscape, characterized by diverging trends across regions and housing types. While the country witnessed a seven percent decline in annual housing starts in 2023 compared to the previous year, the Greater Toronto Area (GTA) defied this trend with a notable five percent increase, reaching a total of 47,428 new starts.

The surge in housing starts in the GTA can be attributed primarily to projects initiated before interest rate hikes, with a sizable portion comprising multi-unit developments, predominantly condos. These projects, which were already in motion before the onset of interest rate adjustments, contributed to the overall uptick in housing starts for the region.

However, as the year progressed, the monthly data for housing starts in the GTA began to decline, reflecting the impact of post-interest rate hike dynamics on demand within the market. This shift underscores the sensitivity of the real estate sector to macroeconomic factors, particularly higher interest rates, which have exerted a significant influence on consumer behavior and residential construction.

Against this backdrop, the Toronto Regional Real Estate Board (TRREB) 2024 Market Outlook and Year in Review report provides insights into the evolving pricing trends in the GTA real estate market. According to the report, the average home price across all types decreased by 5.4 percent in 2023, falling to $1,126,604 from $1,190,749 in 2022.

In 2024, projections indicate a moderate uptick in the average selling price, expected to move closer to $1.17 million. While this forecast would represent the second-highest average price on record, it remains below the peak observed in 2022.

As stakeholders and market participants navigate these fluctuations, the data underscores the importance of monitoring regional and macroeconomic factors to anticipate and adapt to evolving trends in the real estate sector, ensuring resilience and sustainability in the face of headwinds.