As the market has begun to normalize since the unsustainable trends of 2021 and the first half of 2022, California’s Orange County has evolved.

Much to the detriment of the market, the economic turbulence affected Orange County in similar ways to other regions. The record-low supply and rates in the resale and new-home marketplace pushed pricing to unforeseen levels.

Annual new-home sales have been slowing in the Orange County market since 2021. They dropped the most from October to December 2022, with each month experiencing an annual sales decline of 38% to 39%. Currently that drop is around 30% and appears to be showing signs of leveling off. This is a form and function of changing demand as well as limited supply as neighborhoods sold out and replacement neighborhoods were not opened due to various factors.

Annual New-Home Sales

As exhibited below, after 2022’s average sales rate declined to the lowest rate since 2018 to end the year, this year has rebounded closer to seasonal trends. Early returns from March did show a slight slowing in the average sales rate, which could foresee continued uneven results in the Orange County market.

Average Sales Per Month

In general, the attached market has been performing better than the detached market in Orange County, with the attached market making up around 50% of overall sales monthly since 2020 as a more affordable option in the marketplace.

With new neighborhoods being planned in coveted communities like Great Park and Rancho Mission Viejo and upcoming communities in Santiago Hills called Orange Heights, we will continue to watch these trends as the developments by experienced teams come to fruition.

Home builders have been evolving their pricing strategies with incentives like rate buydowns in response to lowered sales numbers. The lowered sales rates have had an effect on base pricing as well.

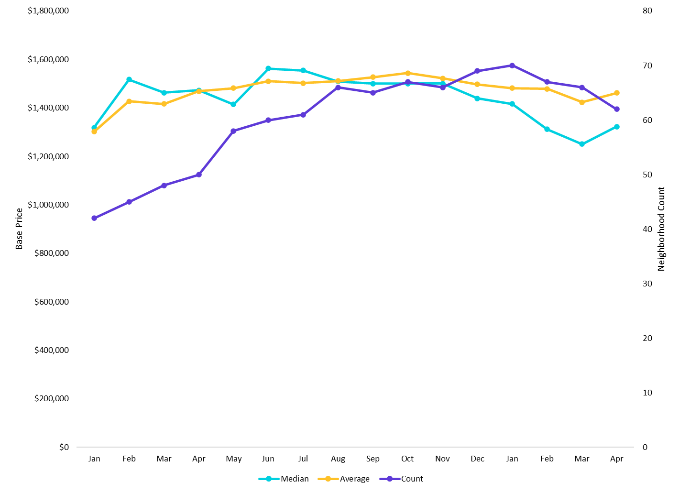

Per Zonda’s proprietary new-home database, detached pricing peaked in July 2022 and attached pricing in October 2022. Each has shown softening since those peaks.

Detached base pricing saw a 7.8% compression as builders evolved to the market swing, while attached base pricing experienced an 8.2% compression. This is coupled with less actively selling neighborhoods with an 11.4% decline as the Orange County market remained constrained for supply.

Orange County Base Pricing Since January 2022

This constraint and the home builder response saw base pricing potentially trough slightly in March, with early returns showing limited price growth in a few neighborhoods in April. In addition to the lowered base pricing, home builders have been controlling their inventory levels, with Zonda’s database of quick move-in (QMI) homes peaking at the end of 2022 and rapidly declining in 2023.

Early tentative returns from Zonda’s proprietary information has exhibited that in addition to QMI homes declining, the number of under construction and inventory homes have continued their downward trends in the first quarter. Further evolution in the resale market will likely keep supply levels low, resulting in a continued undersupply of homes in the Orange County market for the foreseeable future.

Quick Move-In Homes

Despite the uptick in active listings, per the St. Louis Fed’s FRED database, peaking in July/August with 3,999 total listings, the overall active listing count has since fallen to roughly 2,139 (-46.5%) by March. This caused an uptick in pricing in 2023, with listings only off the average peak pricing -1.8% as fewer resale listings have come on the market. Further, fewer homes are reducing their listing price, which seasonally peaks during the summer months. The limited resale supply will continue to be a challenge in the housing market.

As the economy turns, so does Orange County’s ebbing and flowing with the market. While Zonda doesn’t foresee the conditions of 2021 to the first half of 2022 returning, Orange County continues to see demand in the market. The market will be affected by the overall economic trends, the response by the Federal Reserve to inflation, the lack of available supply (land and homes), and home buyer sentiment in the market. It also will likely continue to see growth trends with disruptions focused in different areas of the county.

With our proprietary data, Zonda will delve further into the Orange County market during our Orange County Frame event May 11 and when PCBC returns to Southern California, May 24 to 25, in Anaheim.