Photo: James Bombales

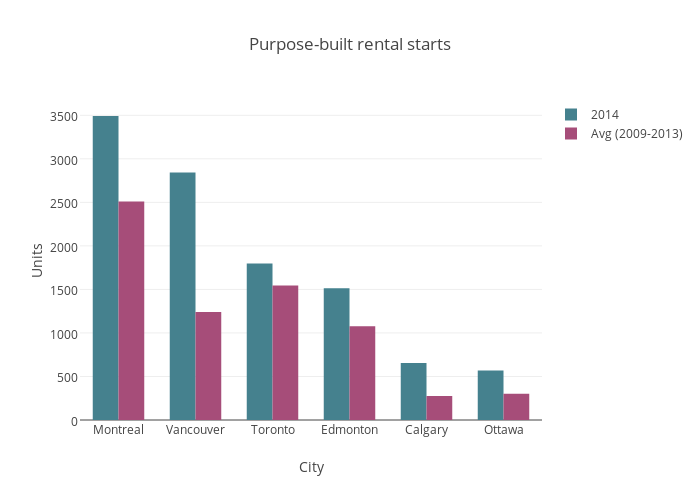

Will Canadian builders swap condos in favour of purpose-built rentals? The latest report from the CBRE, a commercial real estate services company, points to a minor, but intriguing change in the Canadian real estate market. Construction starts for multifamily apartments, or purpose-built rental units in apartment buildings, totalled 15,581 in Canada in 2014. That’s 52.2 per cent higher than the five-year average of 2009 to 2013.

“While only in its infancy, this trend is certainly one to watch,” said CBRE.

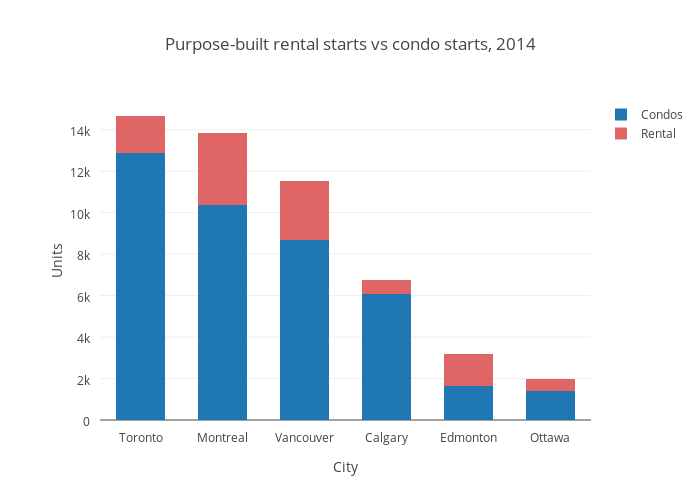

Toronto may lag behind other cities for rental construction (see chart below), but it has seen a number of recent high-profile cases where builders opted for rental. The large-scale Honest Ed’s redevelopment will see some 1,000 rental units built. Downtown condo buildings under construction, such as The Selby and Kingsclub, have been converted to rental.

In 2012, the City of Vancouver council approved the Secured Rental Housing Policy in an effort to incentivize builders to create more 100 per cent purpose-built rental apartments. That partly explains the city’s rise in rental. According to the CBRE report, which is based on CMHC data of rental apartment building construction, Vancouver counted 2,843 rental starts in 2014. The average between 2009 and 2013 was just 1,240.

Here’s a look at how many rental starts other major cities have seen (all data supplied by CBRE):

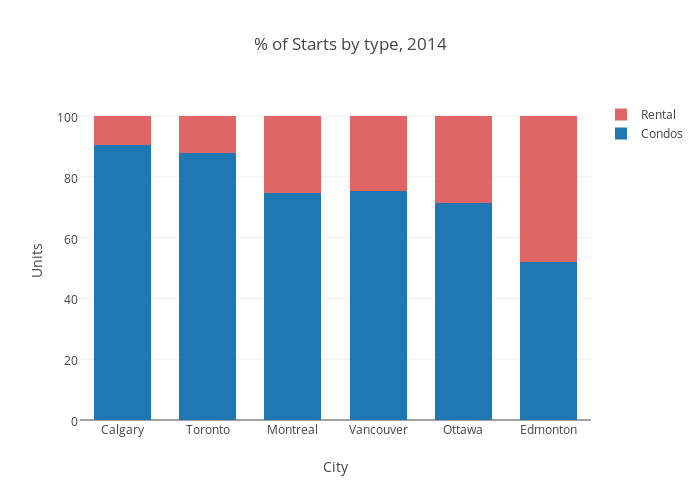

The condo is still very much king, with rental housing just a drop in the bucket when it comes to construction in big cities. For example, in Vancouver, 75.3 per cent of multifamily starts in 2014 were for condo units.

But rental is inching forward. For Vancouver, Calgary, Edmonton, Toronto, Ottawa and Montreal, rental starts made up 20.9 per cent of all multifamily construction in 2014, up from 16.2 per cent the year before.

What’s behind the uptick? CBRE says rising rents are making purpose-built rental construction more financially appealing to developers. Cities have been experiencing low vacancy rates for years. According to the CMHC fall 2014 rental report, the vacancy rate in Vancouver is just 1 per cent. It’s 1.4 per cent in Calgary and 1.6 per cent in Toronto.

Other contributing factors include low interest rates, eroding housing affordability in major cities and growing interest in city living.